Trends in Latin America Flexible Packaging Market 2026

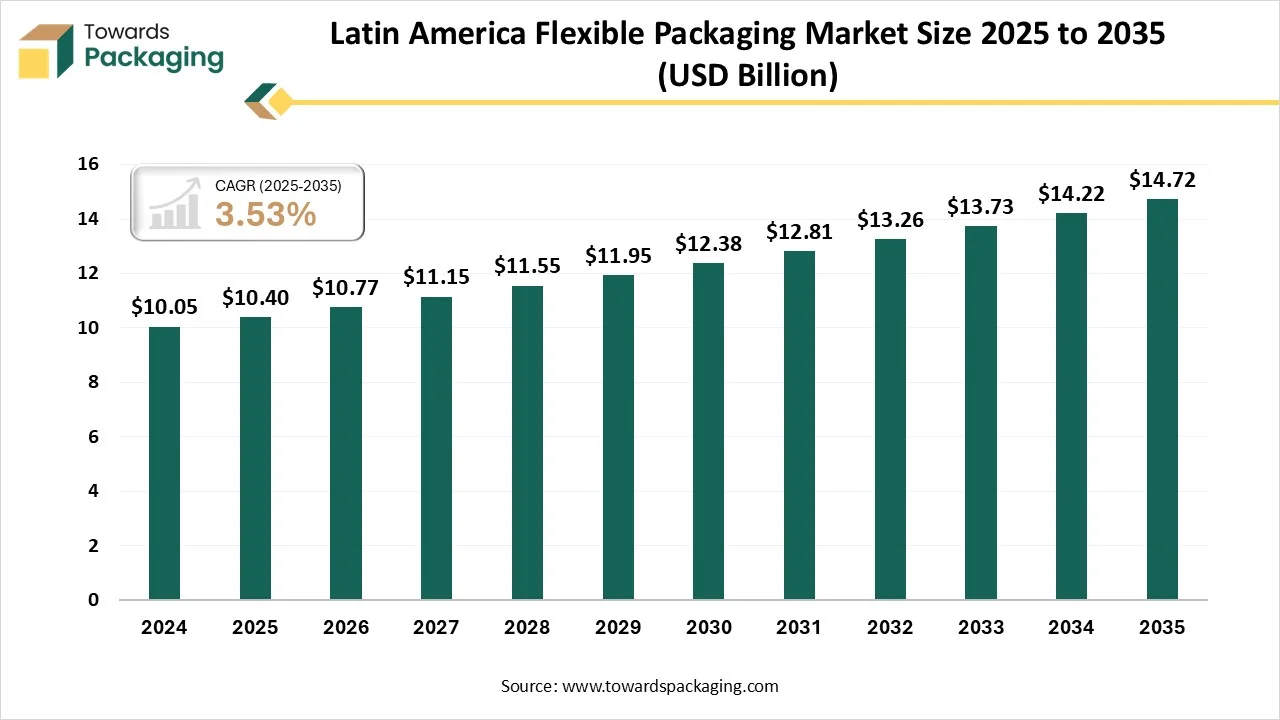

According to Towards Packaging consultants, the Latin America flexible packaging market is projected to reach approximately USD 14.72 billion by 2034, increasing from USD 10.77 billion in 2025, at a CAGR of 3.53% during the forecast period 2025 to 2034.

Ottawa, Jan. 06, 2026 (GLOBE NEWSWIRE) -- The Latin America flexible packaging market which stood at USD 10.40 billion in 2025, is projected to grow further to USD 14.72 billion by 2034, according to data published by Towards Packaging, a sister firm of Precedence Research. The Latin America flexible packaging market is growing steadily, driven by changing consumer lifestyles, rising e-commerce demand, and sustainability trends, with plastics and preformed pouches prominent across food, pharmaceutical, and personal care sectors.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by Flexible Packaging in Latin America?

Latin America’s flexible packaging market is being driven by rapid urbanization, expanding food and beverage consumption, growing e-commerce, and demand for cost-efficient packaging. Rising middle-class incomes, preference for convenience foods, and increasing adoption of sustainable materials by regional manufacturers further accelerate market momentum across countries like Argentina, Brazil, and Chile.

Flexible packaging refers to packaging made from easily adaptable materials such as plastic films, paper, foil, or laminates that can bend or change shape. It includes pouches, sachets, wraps, and bags, offering advantages like lightweight design, extended shelf life, reduced material usage, convenience, and improved product protection during distribution stages.

Argentina emerged as the regional leader in 2024, supported by strong domestic industry dynamics and government initiatives, while firms increasingly adopt eco-friendly materials and advanced printing technologies to meet evolving market needs.

Latin America Government Initiatives for the Flexible Packaging Industry:

- Brazil’s Mandatory Reverse Logistics System (Decree 12.688/2025): Enacted in late 2025, this decree mandates that manufacturers and importers implement systems to recover and recycle 32% of plastic packaging by 2026, rising to 50% by 2040.

- Brazil’s Recycled Content Mandate: Starting in January 2026, large-scale companies in Brazil must incorporate at least 22% recycled content into plastic packaging, a target that progressively increases to 40% by 2040.

- Chile’s Extended Producer Responsibility (EPR) Targets (Law 20.920): Chile has set strict 2025 voluntary and 2030 mandatory targets through its Plastics Pact, aiming for 100% of packaging to be reusable, recyclable, or compostable.

- Mexico’s Strategic Import Tariffs on Packaging: In May 2024, the Mexican government-imposed tariffs of 15% to 35% on 21 packaging and paper products (effective through April 2026) to encourage domestic production and North American sourcing under USMCA.

-

Colombia’s National Circular Economy Strategy (Resolution 1407): This initiative requires producers to develop environmental management plans to increase the recovery of paper, cardboard, and plastic packaging waste, with a specific focus on protecting biodiversity.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5899

What Are the Latest Key Trends in the Latin America Flexible Packaging Market?

1. Sustainability & Recyclable Materials:

There’s a strong shift toward recyclable, compostable, and bio-based films and mono-material formats as brands respond to environmental concerns and regulatory pressure, reducing plastic waste and aligning with circular economy goals.

2. Innovative Packaging Designs:

Manufacturers are introducing functional formats like resealable and stand-up pouches with advanced printing and ergonomic features to boost convenience, shelf appeal, and consumer engagement.

3. E-Commerce-Driven Solutions:

Growth in online retail is increasing demand for lightweight, durable, flexible packaging that protects products during shipping while minimizing cost and transport weight.

4. Smaller & Premium Pack Sizes:

Consumers’ preference for smaller packs and premium presentation is rising, prompting more diverse sizes and higher-quality flexible packaging options across food, personal care, and specialty segments.

5. Raw Material Evolution:

Plastic still dominates, but paper-based and aluminum components are gaining traction due to sustainability and barrier performance advantages, driven by consumer and regulatory demand.

What is the Potential Growth Rate of the Latin America Flexible Packaging Industry?

Expansion of E-commerce & Rising Demand for Flexible Packaging

The expansion of e-commerce and organized retail channels plays a crucial role in driving the growth of the market. Online shopping increases demand for lightweight, durable, and protective packaging that reduces transportation costs and ensures product safety during delivery. Simultaneously, the shift toward sustainability is accelerating market adoption, as manufacturers and brands increasingly focus on recyclable, mono-material, and eco-friendly packaging solutions.

Regulatory pressure, rising environmental awareness, and corporate sustainability commitments are encouraging innovation in materials and designs. Together, these factors are reshaping packaging strategies, supporting wider adoption of flexible packaging across food, consumer goods, and personal care industries.

More Insights of Towards Packaging:

- Sealing and Strapping Packaging Tapes Market Size, Segments and Regional Data (NA/EU/APAC/LA/MEA) 2025-2034

- End-of-Line Packaging Market Size, Share, Growth Analysis, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape 2024-2035

- Punnet Packaging Market Growth Drivers, Challenges and Opportunities

- Aseptic Packaging for Non-Carbonated Beverages Market Size, Share, Trends and Forecast 2024-2035

- Pharmaceutical and Chemical Aluminum Bottles and Cans Market Size, Growth Trends, and Competitive Landscape Report 2025-2035

- Horizontal Form-Fill-Seal (HFFS) Pouching Machines Market Size, Trends, Segments, Regional Insights, Competitive Landscape & Trade Analysis

- Pre-press for Packaging Market Investment Opportunities & Competitive Benchmarking

- Chemical Packaging Material Market Insights, Forecast and Competitive Strategies

- Packaging Wax Market Size, Value Chain & Trade Analysis 2025-2034

- Biodegradable Plastic Films Market Strategic Growth, Innovation & Investment Trends

- Multi-med Adherence Packaging Market Trends and Investment Opportunities

- Cryogenic Labels Market Outlook Scenario Planning & Strategic Insights for 2034

- Wrap-Around Cartoning Machines Market Research Insight: Industry Insights, Trends and Forecast

- Heat Sealable Packaging Market Key Trends, Innovations & Market Dynamics

- Sustainable Secondary Packaging Market Trends, Investment Opportunities & Competitive Benchmarking

- Agricultural Films and Bonding Market Intelligence Report, Key Trends, Innovations & Market Dynamics

- Hazardous Label Market Performance, Trends and Strategic Recommendations

- Isothermal Packaging Market Research Insight: Industry Insights, Trends and Forecast

- Consumer Packaging Market Insights, Forecast and Competitive Strategies

- Single Dose Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics

Country-Level Analysis:

Who leads the Latin America Flexible Packaging Industry Trends?

Argentina's Country dominance in the Latin American market stems from its strong food and beverage sector and export-oriented economy, which drives high packaging demand. A robust domestic industry with advanced manufacturing, efficient logistics networks, and growing consumer preferences for convenient and sustainable packaging formats also boost its leadership position regionally.

Which Factors Make Brazil the Fastest-Growing Country in Latin America?

Brazil’s rapid growth as the fastest-growing country in the market is driven by expanding e-commerce and modern retail, which boost demand for lightweight, durable packaging in online sales and organized stores. The country’s large food & beverage industry, rising consumer preference for convenience formats, and increasing sustainability initiatives also accelerate flexible packaging adoption nationwide.

How Big is the Success of Mexico Country in the Latin America Flexible Packaging Market?

Mexico’s flexible packaging market is notably growing due to its strategic location and favourable trade agreements enhancing export and supply-chain linkages, strong demand from food, pharmaceutical, and personal care sectors, expanding e-commerce requiring lightweight and protective formats, and increased adoption of advanced, sustainable packaging technologies to meet consumer and regulatory expectations.

Segment Analysis

Product Types Insights

What made the Printed Rollstock Segment Dominant in the Latin America Flexible Packaging Market in 2024?

The printed roll stock segment dominates the market because it offers high adaptability and efficiency for large-volume production, supports advanced and customizable printing technologies, enhances branding and shelf appeal, and accommodates sustainable materials like recyclable and compostable films, meeting evolving consumer and regulatory demands across food, personal care, and other sectors.

The preformed bags and pouches segment is the fastest-growing in the market because its lightweight, durable, and easy-to-handle design meets rising consumer demand for convenience, supports efficient e-commerce logistics and product protection, and aligns with sustainability trends as brands adopt recyclable and biodegradable formats.

Raw Materials Insights

How the Plastic dominate the Latin America Flexible Packaging Market in 2024?

The plastic segment dominates the market because plastics are highly durable, versatile, and cost-effective, offering excellent barrier protection, chemical resistance, and moisture control for diverse products across food, personal care, and other sectors. Their lightweight nature reduces transportation costs, supports advanced designs, and meets growing demand from e-commerce and modern retail channels.

The paper segment is the fastest-growing in the market because rising environmental awareness, stricter regulations on plastic use, and strong consumer demand for sustainable, recyclable alternatives are driving brands to adopt paper-based solutions. Innovation in paper materials also improves functionality and performance, helping them better compete with traditional plastics in flexible packaging applications.

Printing Technology Insights

What made the Flexography Printing Segment Dominant in the Latin America Flexible Packaging Market in 2024?

The flexographic printing segment dominates the market because it offers cost-effective, high-speed printing suited for large production runs, excellent versatility across films, paper, and foils, and reliable quality for branding and compliance. Its compatibility with sustainable inks and substrates, plus efficiency for bulk flexible packaging needs, makes it a preferred technology regionally.

The digital printing segment is gaining dominance in the market because it enables highly customizable, short-run production with fast turnaround, enhancing brand differentiation and shelf appeal. It also supports variable data, traceability features, and stronger engagement, meeting rising e-commerce and sustainability demands while improving supply-chain efficiency and responsiveness to market trends.

Application Insights

What made the Food and Beverages Segment Dominant in the Latin America Flexible Packaging Market in 2024?

The food and beverages segment dominates the market because flexible packaging extends product shelf life, offers convenience for ready-to-eat and on-the-go consumption, and supports efficient e-commerce distribution. Its versatility for diverse food products and strong demand from growing regional food and drink sectors drive widespread adoption.

The pharmaceutical segment is the fastest-growing flexible packaging application in Latin America because expanding healthcare access and rising chronic disease prevalence increase medicine demand, stringent regulatory and safety requirements drive adoption of advanced barrier, tamper-evident, and compliant packaging, and flexible formats offer lightweight, protective solutions suited for modern pharmaceutical distribution and labeling needs.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Latin America Flexible Packaging Industry

- In November 2025, Andina Pack, powered by Anuga FoodTec 2025, opened in Bogotá as a major platform showcasing the latest in packaging, printing, and processing technology. National and regional companies highlighted innovations in automation, flexible packaging machinery, and sustainable materials. The event strengthened Latin America’s role as a hub for packaging technology exchange and industry advancement.

- In October 2025, Amcor inaugurated a new Machine Direction Orientation (MDO) line at its Peru facility, boosting regional capacity to produce AmPrima Plus recycle-ready films. The advanced technology strengthens material performance while enabling mono-material recyclable structures, aligning with circular economy goals. This investment underscores Amcor’s strategic push toward sustainable flexible packaging solutions throughout Latin America.

- In April 2025, Dole Food Company expanded the commercial use of its Oxifilm recyclable macro-perforated stretch film across banana and pineapple operations in multiple Latin American countries. This innovation replaces conventional straps, clamps and boards, significantly reducing traditional plastic use per pallet and improving palletizing efficiency. The film’s recyclable design supports both sustainability and enhanced operational performance across fruit supply chains.

- In December 2024, W-Cycle and Brazilian firm Melhoramentos Latin America partnered to introduce advanced compostable flexible food packaging made from renewable, food-grade materials. The collaboration focuses on biodegradable alternatives that naturally decompose within about 100 days, targeting snacks and fresh foods.

Top Companies in the Latin America Flexible Packaging Market & Their Offerings:

- Amcor Plc: Supplies high-barrier films, recyclable pouches, and healthcare packaging across a vast regional manufacturing network.

- Mondi Plc: Produces sustainable paper-based bags and recyclable mono-material plastic films via its Colombian operations.

- Sealed Air Corporation: Specializes in Cryovac shrink bags and automated vacuum packaging systems for the protein and food sectors.

- Coveris: Offers specialized shrink sleeves, labels, and agricultural plastics tailored for the Mexican and Central American markets.

- Tetra Pak: Provides aseptic paperboard-based flexible cartons designed for the long-term shelf stability of liquids and dairy.

- ALPLA Group: Manufactures high-performance flexible preforms, closures, and industrial containers through regional technical hubs.

- Videplast: Delivers advanced multi-layer vacuum films and high-resistance bags for the Brazilian food and industrial segments.

- Zubex: Produces high-barrier thermo-shrinkable packaging and proprietary biodegradable films for the Mexican food industry.

Segment Covered in the Report

By Product Types

- Printed Rollstock

- Preformed Bags and Pouches

- Others

By Raw Materials

- Plastic

- Paper

- Aluminium Foil

- Cellulose

By Printing Technologies

- Flexography

- Rotogravure

- Digital

- Others

By Applications

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Others

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5899

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Smart Bottle Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies

- Inverted Pouches Market Review, Key Business Drivers & Industry Forecast

- Fiber-Based Bottles Market Research Insight: Industry Insights, Trends and Forecast

- Premix Packaging Machine Market Dynamics, Competitive Forces & Strategic Pathways

- Packaging Watermarking Technology Market Size, Trends and Strategic Recommendations

- Accessible Packaging Market Key Business Drivers & Industry Forecast

- Compostable and Recyclable Cups Market Strategic Growth, Innovation & Investment Trends

- Lightweight Packaging Market Trends, Challenges & Strategic Recommendations

- Nordic Beverage Packaging Market Research, Consumer Behavior, Demand and Forecast

- Carded Packaging Market Intelligence Report, Key Trends, Innovations & Market Dynamics

- Liquid IBC Market Research Insight Industry Insights, Trends and Forecast

- Wet Glue Labels Market Emerging Trends, Investment Opportunities and Competitive Benchmarking

- Mobile Phone Packaging Market Strategic Analysis & Growth Opportunities

- Starch-based Bioplastics Market Consumer Insights & Growth Strategies

- Recyclable Carrier Bags Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies

- Tamper Proof Packaging Market Insights, Forecast and Competitive Strategies

- Packaging Primer Market Review, Key Business Drivers & Industry Forecast

- Spirotetramat Packaging Market Strategic Growth, Innovation & Investment Trends

- Cut Flower Packaging Market Insights, Forecast and Competitive Strategies

- Grab and Go Containers Market Insights, Forecast and Competitive Strategies

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.